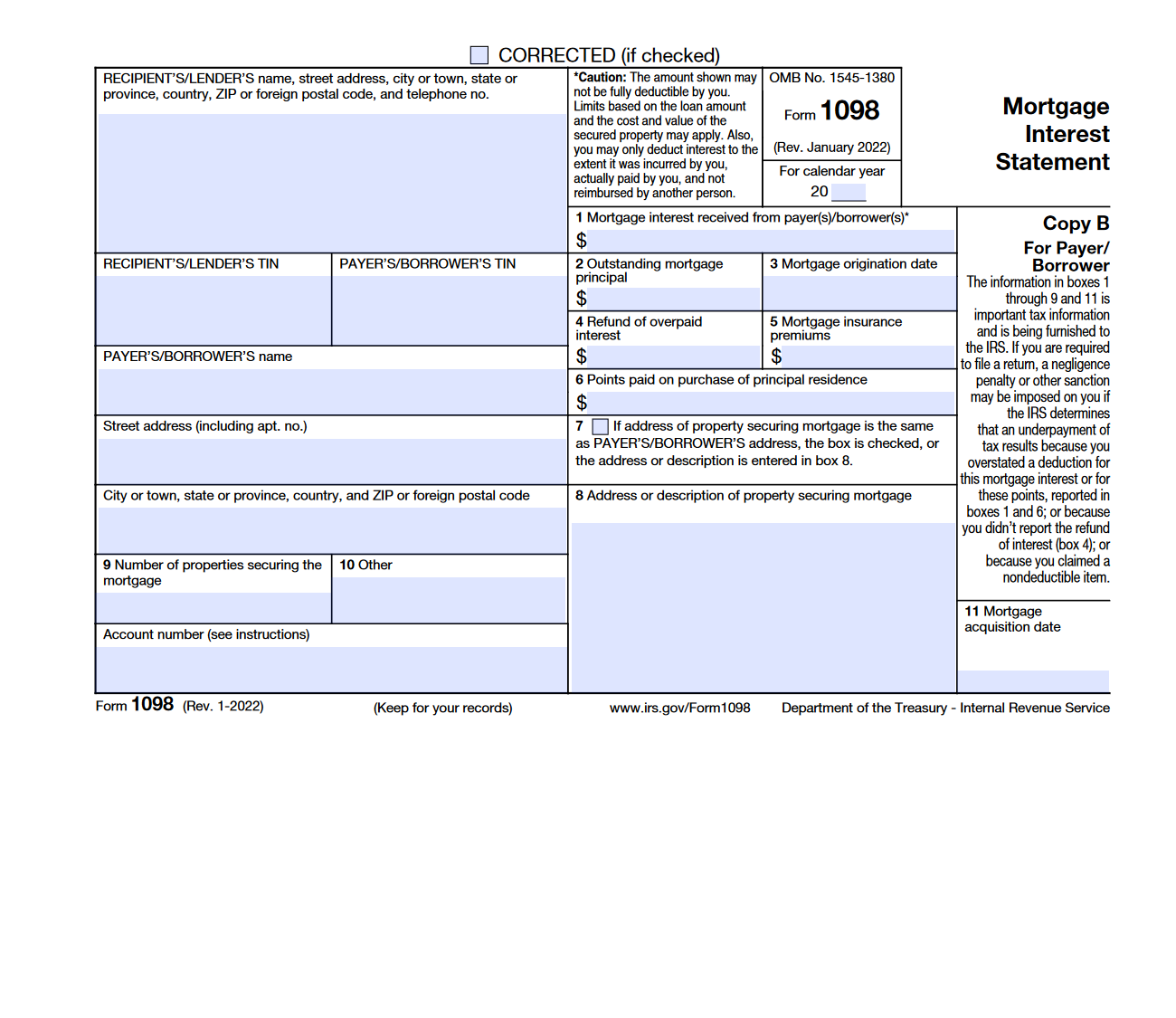

Form 1098 Mortgage Interest 2024

Form 1098 Mortgage Interest 2024. It shows how much interest you paid on. Find out how lenders use it to report mortgage interest, insurance premiums, and points.

Every year, rocket mortgage ® is required to report form 1098, the mortgage interest statement, to the internal revenue service (irs) for. Generally, you can deduct the home mortgage interest and points reported to you on form 1098 on schedule a (form 1040), line 8a.

Home Mortgage Interest And Points Are Generally Reported To You On Form 1098, Mortgage Interest Statement, By The Financial Institution To Which You Made The Payments For The.

Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance.

It’s Crucial For Homeowners, Especially Those With.

This tax form shows how much mortgage interest you paid during the year, which you can use to claim a deduction on your income tax return.

Use Form 1098 (Info Copy Only) To Report Mortgage Interest Of $600 Or More Received By You During The Year In The Course Of Your Trade Or Business From An Individual, Including A Sole Proprietor.

The 1098 is your mortgage interest statement.

Images References :

Source: blanker.org

Source: blanker.org

IRS Form 1098. Mortgage Interest Statement Forms Docs 2023, Lenders and businesses that receive these payments are required to record them on. If you didn't get your.

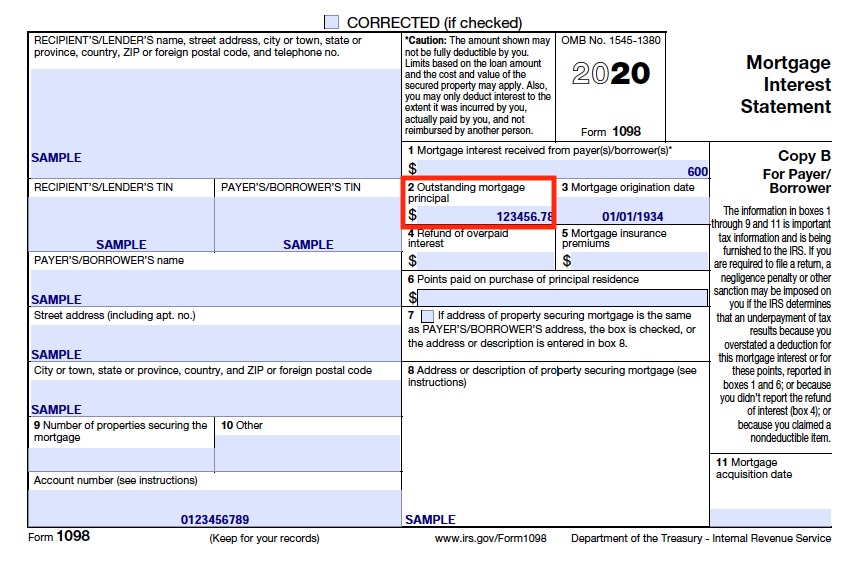

Source: www.dochub.com

Source: www.dochub.com

2020 form 1098 mortgage interest Fill out & sign online DocHub, Every year, rocket mortgage ® is required to report form 1098, the mortgage interest statement, to the internal revenue service (irs) for. Somehow, it’s 2024, and there's only 30 days left to prep those tax returns.

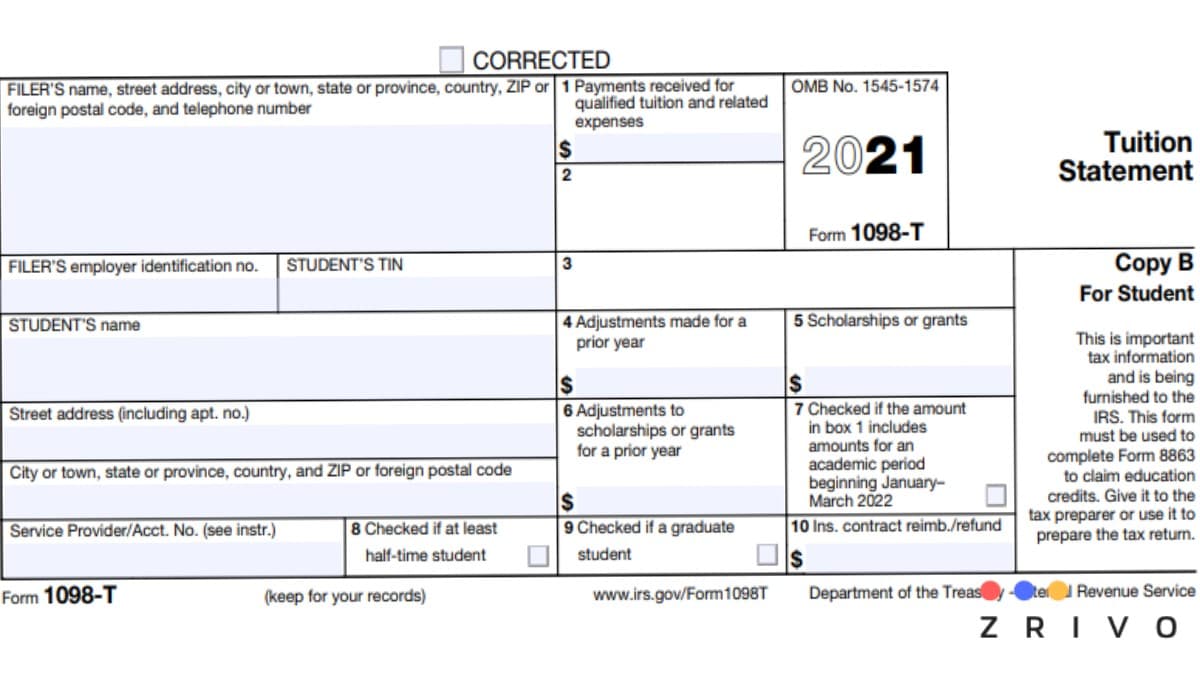

Source: www.zrivo.com

Source: www.zrivo.com

1098T Form 2024, Discover if you qualify for a mortgage interest deduction, where to report form 1098 on. The deduction is only available for interest paid on the first $750,000 of your mortgage debt.

:max_bytes(150000):strip_icc()/ScreenShot2021-10-01at12.36.46PM-516841a2dc40455cbb7f24f872435284.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

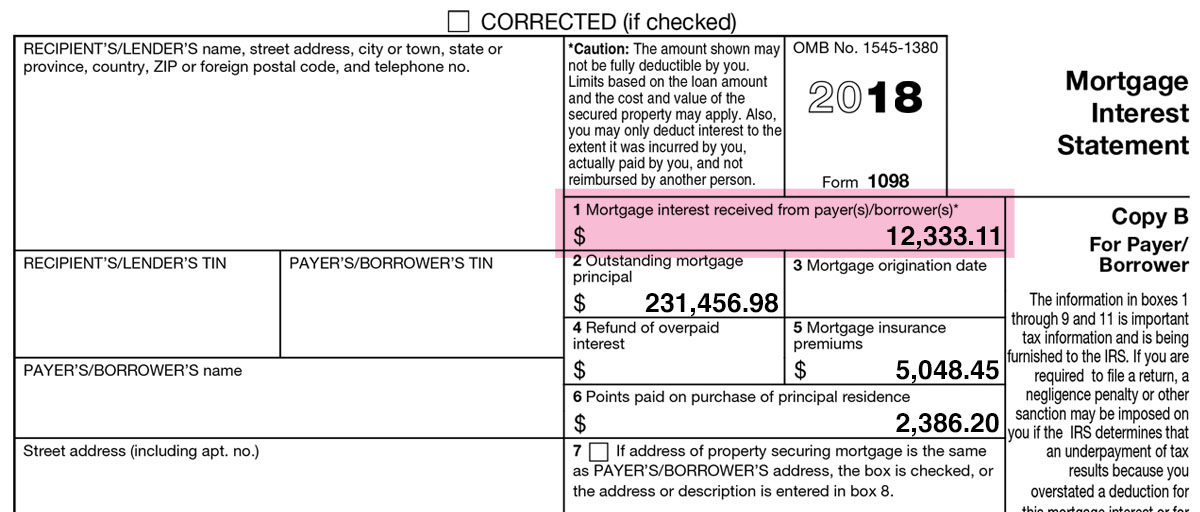

What Is IRS Form 1098?, Generally, you can deduct the home mortgage interest and points reported to you on form 1098 on schedule a (form 1040), line 8a. Filing form 1098 accurately and on.

/Form1098-5c57730f46e0fb00013a2bee.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Form 1098 Mortgage Interest Statement and How to File, You can use that information to lower your tax bill! The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions.

Source: www.ubu.bank

Source: www.ubu.bank

1098 Mortgage Interest Forms United Bank of Union, If you paid more than $600 in mortgage interest last year, keep an eye out for a form 1098 from your mortgage lender in the coming weeks, (early 2024). Find out how lenders use it to report mortgage interest, insurance premiums, and points.

Source: oforms.onlyoffice.com

Source: oforms.onlyoffice.com

Form 1098 (Mortgage Interest Statement) template, You can use that information to lower your tax bill! Basically, form 1098 tells you how much mortgage interest you paid during the year.

Source: activerain.com

Source: activerain.com

Form 1098 and Your Mortgage Interest Statement, Form 1098 is used to payments of mortgage interest, mortgage insurance premiums and points in excess of $600. Find out how lenders use it to report mortgage interest, insurance premiums, and points.

Source: www.halfpricesoft.com

Source: www.halfpricesoft.com

How to Print and File Tax Form 1098, Mortgage Interest Statement, Lenders and businesses that receive these payments are required to record them on. Do not send a form (1099, 5498, etc.).

Source: www.halfpricesoft.com

Source: www.halfpricesoft.com

How to Print and File Tax Form 1098, Mortgage Interest Statement, Form 1098 is used to payments of mortgage interest, mortgage insurance premiums and points in excess of $600. It shows how much interest you paid on.

Irs Form 1098 For 2023 Is Used To Report The Amount Of Interest And Related Expenses Related To The Mortgage During The Fiscal Year.

States that assess an income tax also may allow homeowners to claim.

Yes, Your Deduction Is Generally Limited If All Mortgages Used To Buy, Construct, Or Improve Your First Home (And Second Home If Applicable) Total More Than $1.

It shows how much interest you paid on.

This Tax Form Shows How Much Mortgage Interest You Paid During The Year, Which You Can Use To Claim A Deduction On Your Income Tax Return.

Lenders and businesses that receive these payments are required to record them on.

Category: 2024